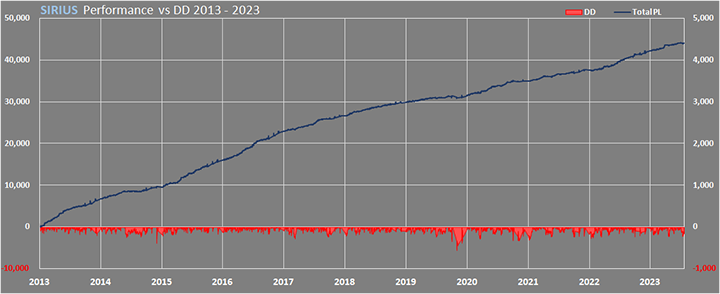

Luxstella Bright Star Strategy

Luxstella Bright Star Strategy

Financial professionals, inspired by the concept of FinTech, offering automated investment solutions that combine AI and algorithmic trading.

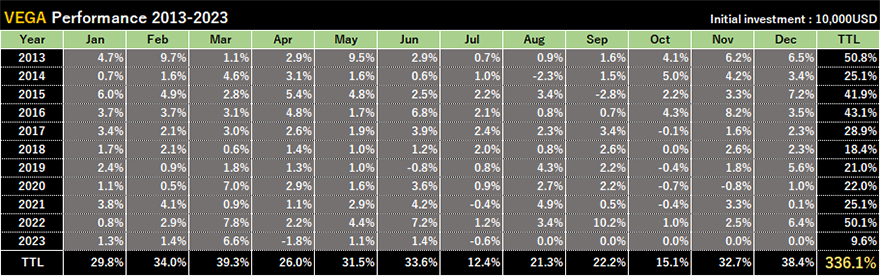

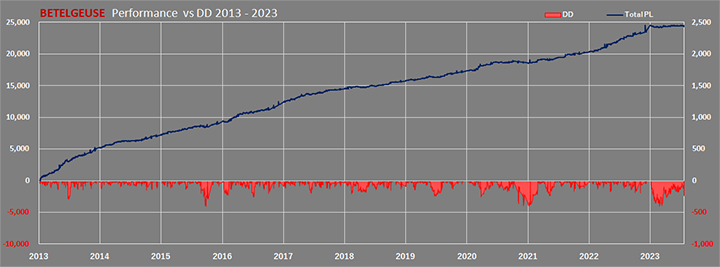

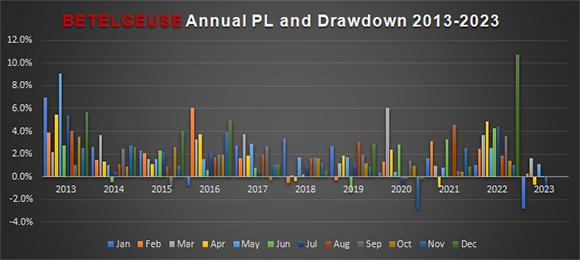

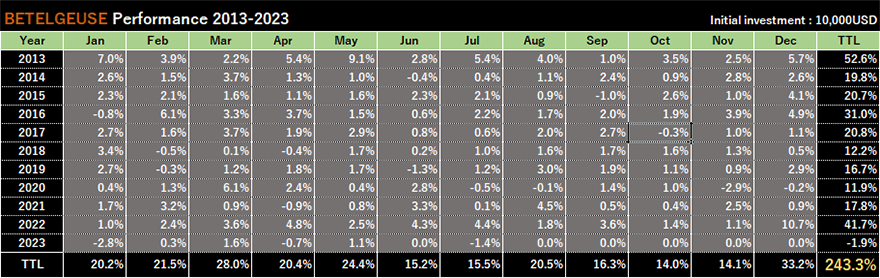

Choose from three strategies that match your investment goals and risk tolerance.

Luxstella Bright Star Strategy

Application and Requirements

- Investment Unit

- Minimum of $1,000, with increments of $1,000.

- Investment Amount

- Applications received by the end of day (EOD) on Thursdays will be calculated based on the net asset value (NAV) of Thursday.

- Investment Payment

- Payment in USD is required when submitting a purchase application.

- Redemption Amount

- Applications received by the end of day (EOD) on Thursdays will be calculated based on the net asset value (NAV) of Thursday.

- Redemption Payment

- Normally, the payment will be deposited into your account on the fifth business day after the NAV application date (transaction date).

- Application Acceptance Time

- Applications are accepted up to the end of day (EOD) on Thursdays.

- Non-Application and Non-Redemption Days

- Typically, the holidays include New York Stock Exchange holidays, bank holidays in New York, and holidays in various countries.

- Redemption Limit

- To facilitate the efficient management of the Luxstella Bright Star Strategy, redemptions exceeding $100 million in a single day are not permitted. Additionally, large redemptions may be subject to further restrictions.

- Termination and Cancellation of Investment and Redemption Application Processing

- In cases of trading suspension on exchanges, unforeseen system maintenance, or other unavoidable circumstances, the acceptance of purchase and redemption applications may be suspended, and previously accepted applications may be canceled.

- Investment Period

- Generally indefinite, but early redemption may occur in case of unavoidable circumstances.

Direct Investor Costs

- Investment Fee

- NO CHARGE

- Redemption Fee

- NO CHARGE

Indirect Investor Costs

- Management Fee

- 1.0 percent (annual) of the Net Asset Value.

- High Watermark Method

- 20 percent of any increase in Net Asset Value above the High Watermark.

High Watermark

“High Watermark” refers to the benchmark price used for calculating the “Success Fee,” one of the management fees. If the benchmark price surpasses the High Watermark, the success fee is deducted from the managed assets. Please note that the total amount of such fees and expenses varies depending on the duration of investors’ holdings in the fund and other factors, so it cannot be displayed.

Risk and Disclosure

Unlike deposits in financial institutions, there is no guarantee of principal and interest. Furthermore, the value may fluctuate due to factors such as the assets included, trading methods, exchange rate variations, and other influences, which may result in a decrease in the investment principal. The decision to invest is solely the responsibility of the customer.

Open an account in about 5 minutes

By entering your full name, email address, and password, you can open an account, making the account opening process very simple.

-

New experiences at Luxstella

Open an Account -

Manage accounts and transactions

Login